By Nikky Ly, Tax & Advisory Manager

ASL Real Estate Group

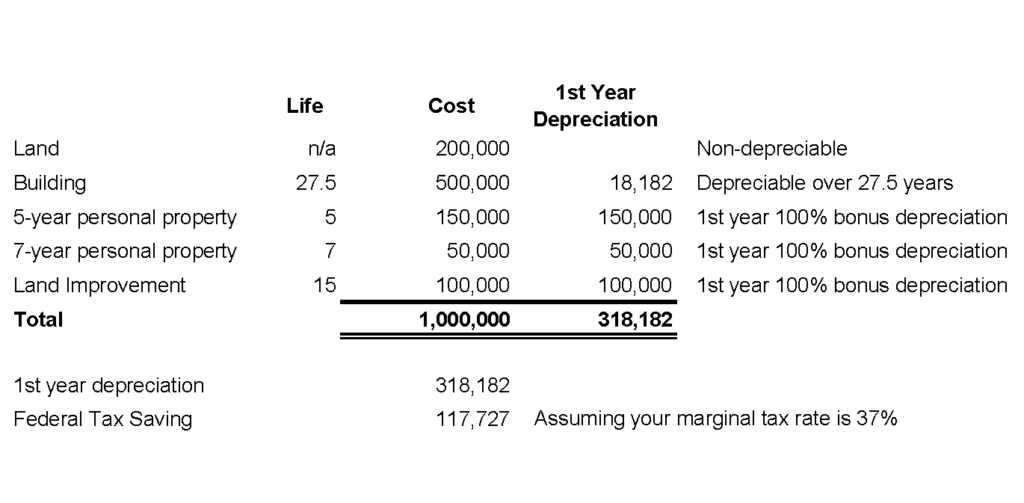

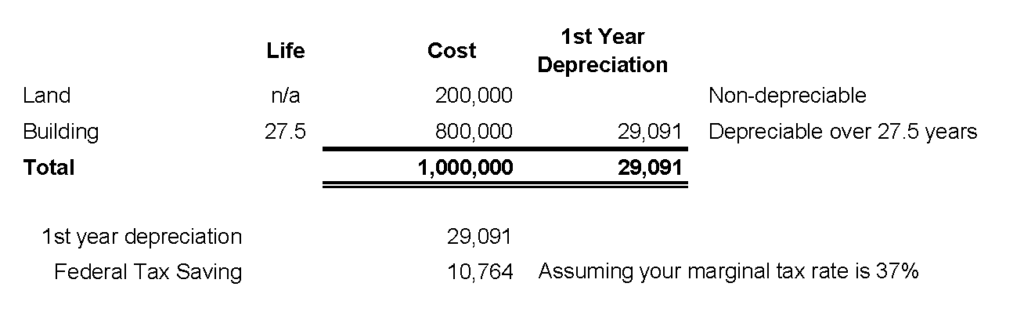

Imagine you just bought a rental property for $1 million with $200,000 down payment, your CPA says “Congratulations! You are saving over $10,000 in federal tax with this purchase.” Here is the breakdown:

Paying $200,000 and getting $10,000 in tax saving, that’s 5% return on investment. Not bad… right? What if I told you we can save you $100,000 immediately by utilizing a cost segregation study?

What is a Cost Segregation Study?

A cost segregation study is a detailed study to break down the real property into different components and re-classify them into their appropriate depreciation recovery periods. When buying a new property, the most common allocation for depreciation is what is shown in the above example: land (non-depreciable) and building (depreciable over 27.5 or 39 years). However, within the “building”, there are other components, such as HVAC, plumbing systems, cabinets, appliances, etc., other than the structure itself, which can be depreciated over shorter periods than 27.5 or 39 years. The goal of a cost segregation study is to separate the building into components with shorter recovery periods.

Accelerating Depreciation

A cost segregation study can break the “building” down into shorter-life components, and the main purpose of this is to accelerate depreciation deductions, resulting in more tax savings in the early years. If you keep the building for 27.5 years, your net benefit of depreciation deductions is still the same. However, considering the time value of money, many taxpayers prefer to have the tax savings earlier rather than later. As a result, considering a cost segregation study can be a wise decision.

- Accelerating depreciation deductions on assets with a shorter life and bonus depreciation

By reclassifying a component of the “building” to a 5-, 7- or 15-year asset, we can depreciate the asset over a shorter period. Starting from late 2017 under the Tax Cuts and Jobs Act, the savings is even more substantial with 100% bonus depreciation. In other words, you can write-off the full cost of your 5-, 7- or 15-year assets in the first year, instead of depreciating over 27.5 years. Let’s go back to our example at the beginning of the article. If you have a cost segregation study done, your tax savings for the first year could be as much as $117,727, instead of $10,764. Below is the calculation:

- Accelerating depreciation deductions with dispositions of components

The acceleration of depreciation deductions doesn’t stop at the first year of the cost segregation study. There is also a benefit when you dispose of any old component, which was identified in the cost segregation study. A classic example of this is a disposition of an old roof. Let’s say, 8 years after your initial purchase, you need to replace the roof. The cost of the new roof is $64,000, so you add the new roof into your depreciation schedule and start depreciating it over 27.5 years. What about the old roof? It’s gone, isn’t it? Not from your depreciation schedule. If you did not have a cost segregation study, it is hard to write-off the cost of the old roof since you don’t know what the cost is. However, if you had a cost segregation study performed, which allocated $48,000 to your old roof at time of purchase, and you took $13,600 of depreciation over 8 years you can easily write-off the remaining balance of $34,400, allocated to the old roof.

When Should a Cost Segregation Study Be Performed?

- Year of purchase:

The most common time for cost segregation study is in the first year the property is placed in service. This provides the taxpayer with the earliest deductions possible, and insures any dispositions of components can be written-off thereafter. - Year of construction/renovation:

Cost segregation study can also be performed after a major renovation, construction or addition to the existing building. Similar to the year of purchase, the cost segregation study in the year of renovation provides the taxpayer with the earliest deductions for the new components being added. - Year of inheritance:

When you inherit an appreciated rental property, the tax basis of the inherited property gets stepped-up to the fair market value at the decedent’s date of death. In other words, all the prior depreciation is gone, and you have a brand-new basis to start depreciating again. You can have a cost segregation study done and enjoy the similar benefits as if you just purchased or renovated the property. However, inherited property does not qualify for bonus depreciation since you did not purchase it. - Year of significant income:

If you did not have a cost segregation study done in any of the situations listed above, it is not too late. You can have a cost segregation study done any time after the purchase through a process called a “lookback” study. Basically depreciation in prior years will be recomputed based on the cost segregation study, and you will get a catch-up deduction for the difference between your actual depreciation deductions and the recomputed depreciation. In fact, this is a preferred method if your income fluctuates from year to year, and the first year of purchase does not give you much tax benefit.

Things to Consider:

- The cost of the study itself:

There is a cost associated with the cost segregation study. This cost depends on the size of the property, building type, and/or other physical characteristics of your property. - No income to shelter:

If you have very minimal income, which brings you to a very tax low bracket for the year, a cost segregation study may not yield a significant tax savings. - Passive activity loss limitations:

If your rental generates a passive loss for the year, and you have no other passive income to offset the loss, accelerated depreciation might not provide immediate benefits due to the passive activity loss limitation rules. - Potential larger gain upon sale:

Accelerating depreciation using a cost segregation study in an earlier year will cause your property to have a lower tax basis. As a result, this will create a larger gain later upon sale. - Property not eligible for tax deferred exchange:

The Tax Cuts and Jobs Act changed the classification of property eligible for a tax deferred like-kind exchange to include only real property. Therefore, when you exchange your real property, if any portion of the property was classified as “personal property” under the cost segregation study, it would not qualify as “like-kind property” eligible for an exchange, and therefore may result in the exchange being partially taxable. - Possible tax rate changes:

If tax rates are expected to increase in the near future, it might be better to hold off on performing the cost segregation study. This will leave the cost segregation study as an option for you to lower your income in the future, which could yield greater tax savings under the higher rates.

Contact Us

If you have any questions about the information outlined above, or need assistance determining whether or not performing a cost segregation study is the right move for you, Abbott, Stringham & Lynch’s Real Estate Group can help. For additional guidance, please contact us here, or call us at 408-377-8700. We look forward to speaking to you soon!